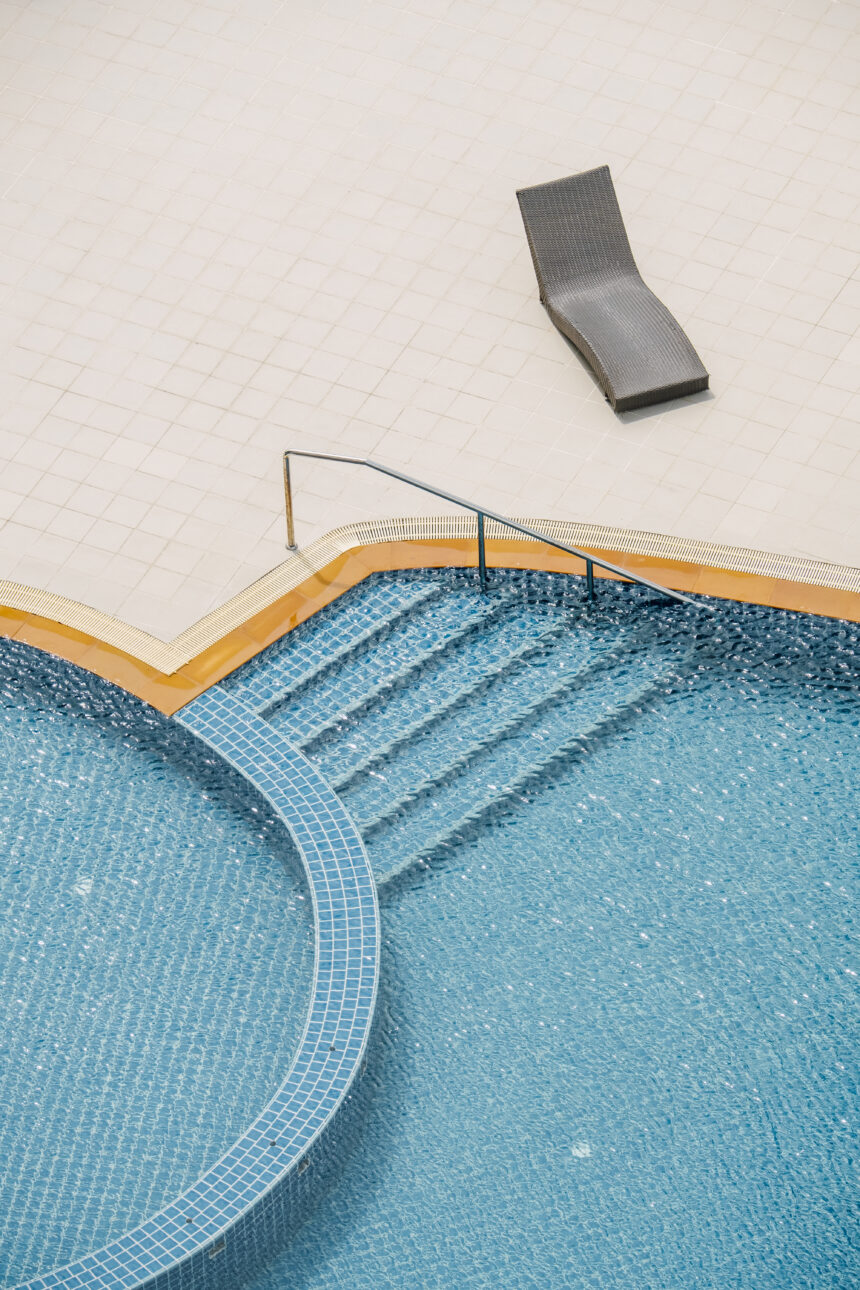

Adding a swimming pool or other outdoor structures to your property can enhance its beauty, functionality, and overall value. However, it’s important to consider the insurance implications of these additions to ensure that you have adequate coverage in case of damage or liability. Understanding how home insurance applies to swimming pools and outdoor structures will help you make informed decisions and protect your investment. Here’s a closer look at what you need to know:

- Coverage for swimming pools: Home insurance policies typically cover swimming pools, but the extent of coverage may vary. Some policies include swimming pools as part of the dwelling coverage, while others may require additional endorsements or separate coverage options. It’s crucial to review your policy to understand how swimming pools are addressed and whether any limitations or exclusions apply.

- Liability coverage: Swimming pools can present potential liability risks. Home insurance policies typically include liability coverage, which protects you financially if someone is injured or drowns in your pool. However, it’s important to ensure that your liability coverage is sufficient to address the increased risks associated with a swimming pool. Consider increasing your liability limits or adding an umbrella policy for additional protection.

- Maintenance requirements: Insurance providers may have specific maintenance requirements for swimming pools. These requirements often include measures such as installing a fence or gate around the pool area, using safety covers when the pool is not in use, and implementing safety features like alarms or pool covers. Failure to comply with these requirements may result in coverage limitations or even denial of claims related to pool incidents.

- Damage coverage: Home insurance policies typically cover damage to swimming pools caused by covered perils, such as fire, lightning, vandalism, or severe weather events. However, damage caused by wear and tear or lack of proper maintenance may not be covered. It’s important to understand the specific terms and limitations of your policy to determine what types of pool damage are covered and under what circumstances.

- Outdoor structures coverage: In addition to swimming pools, other outdoor structures such as sheds, gazebos, pergolas, or detached garages are also subject to insurance coverage. These structures are typically covered under the “other structures” portion of your home insurance policy. However, the coverage limit for other structures is often a percentage of the dwelling coverage limit. Ensure that your coverage limit is sufficient to rebuild or repair these structures in case of damage.

- Additional endorsements: Depending on the value and complexity of your outdoor structures, you may need additional endorsements or separate coverage options. For example, if you have an elaborate pool house or a custom-built outdoor kitchen, standard coverage limits may not be adequate. Consider discussing your specific needs with your insurance provider to explore options for additional endorsements or tailored coverage.

- Risk mitigation measures: Implementing safety measures and risk mitigation strategies can help minimize potential incidents and may even result in insurance premium discounts. Installing safety fences, pool alarms, and proper lighting can make your pool area safer and reduce the likelihood of accidents. Consult with your insurance provider to determine which safety features are recommended or required to qualify for coverage and potential discounts.

- Regular policy review: It’s important to regularly review your home insurance policy to ensure that it accurately reflects any changes or additions to your property, including swimming pools and outdoor structures. Inform your insurance provider about any modifications or upgrades to ensure that your coverage adequately reflects the value and risk associated with these additions.

By understanding the nuances of home insurance coverage for swimming pools and outdoor structures, you can protect your investment and enjoy these features with peace of mind. Consult with your insurance provider to assess your specific needs, review your policy, and explore any additional coverage options to ensure that you have the appropriate protection in place.